All Categories

Featured

Table of Contents

It's vital to note that your cash is not directly purchased the stock exchange. You can take cash from your IUL anytime, but costs and surrender fees might be connected with doing so. If you require to access the funds in your IUL plan, considering the advantages and disadvantages of a withdrawal or a funding is vital.

Unlike straight financial investments in the securities market, your money worth is not straight purchased the hidden index. Rather, the insurer makes use of monetary instruments like choices to link your cash money value development to the index's efficiency. One of the distinct features of IUL is the cap and floor prices.

Who are the cheapest Flexible Premium Indexed Universal Life providers?

Upon the policyholder's death, the beneficiaries obtain the fatality benefit, which is generally tax-free. The survivor benefit can be a set amount or can consist of the money value, relying on the policy's structure. The money worth in an IUL plan expands on a tax-deferred basis. This means you don't pay tax obligations on the after-tax funding gains as long as the cash stays in the plan.

Constantly evaluate the plan's details and speak with an insurance expert to totally recognize the advantages, limitations, and prices. An Indexed Universal Life Insurance coverage plan (IUL) uses a distinct blend of attributes that can make it an eye-catching choice for specific individuals. Below are some of the crucial benefits:: Among one of the most enticing aspects of IUL is the possibility for higher returns compared to various other types of irreversible life insurance coverage.

How can Iul Death Benefit protect my family?

Taking out or taking a loan from your policy might lower its cash worth, survivor benefit, and have tax implications.: For those thinking about tradition planning, IUL can be structured to provide a tax-efficient method to pass wealth to the following generation. The fatality advantage can cover estate taxes, and the cash value can be an extra inheritance.

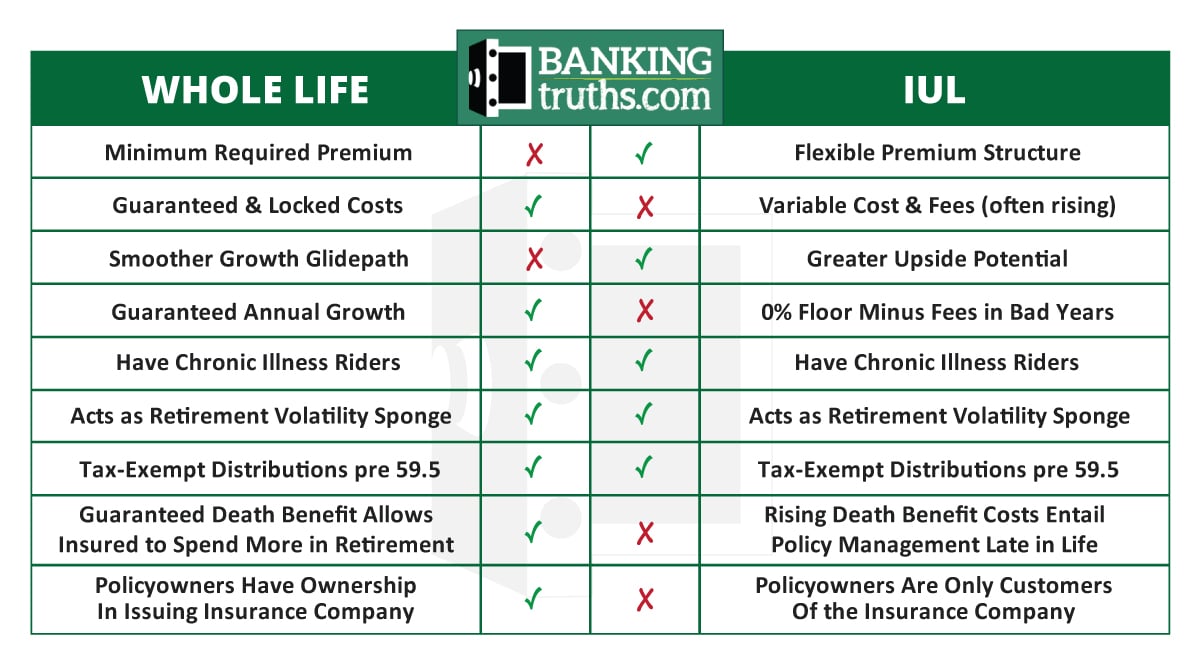

While Indexed Universal Life Insurance Coverage (IUL) offers a variety of benefits, it's necessary to take into consideration the potential downsides to make a notified choice. Here are several of the key disadvantages: IUL policies are much more complicated than traditional term life insurance coverage policies or entire life insurance policy plans. Comprehending how the money worth is connected to a securities market index and the ramifications of cap and floor prices can be testing for the ordinary consumer.

The premiums cover not only the price of the insurance coverage however additionally administrative fees and the financial investment part, making it a pricier option. IUL for retirement income. While the cash money worth has the capacity for development based on a stock market index, that growth is frequently topped. If the index does extremely well in a given year, your gains will certainly be restricted to the cap price defined in your plan

: Adding optional features or cyclists can increase the cost.: How the policy is structured, including just how the cash worth is assigned, can additionally influence the cost.: Various insurer have different prices models, so looking around is wise.: These are fees for taking care of the policy and are normally deducted from the cash money value.

Who has the best customer service for Indexed Universal Life?

: The expenses can be comparable, however IUL uses a flooring to help secure versus market recessions, which variable life insurance policy policies normally do not. It isn't simple to provide a specific expense without a particular quote, as rates can differ significantly in between insurance coverage suppliers and private scenarios. It's essential to balance the relevance of life insurance and the requirement for added defense it supplies with potentially higher premiums.

They can aid you comprehend the expenses and whether an IUL plan lines up with your economic goals and needs. Whether Indexed Universal Life Insurance Coverage (IUL) is "worth it" is subjective and relies on your monetary objectives, risk resistance, and lasting preparation requirements. Here are some indicate consider:: If you're seeking a lasting financial investment car that provides a death benefit, IUL can be a good choice.

1 Your policy's cash money value need to suffice to cover your regular monthly charges - Indexed Universal Life premium options. Indexed global life insurance coverage as utilized below refers to plans that have not been registered with U.S Securities and Exchange Commission. 2 Under existing government tax regulations, you might access your cash money surrender worth by taking federal income tax-free car loans or withdrawals from a life insurance policy policy that is not a Customized Endowment Agreement (MEC) of approximately your basis (complete costs paid) in the policy

What is included in High Cash Value Iul coverage?

If the policy gaps, is surrendered or ends up being a MEC, the loan balance at the time would normally be considered as a distribution and as a result taxable under the general rules for circulation of policy money worths. This is a very basic description of the BrightLife Grow product. For costs and more total details, please call your financial specialist.

While IUL insurance coverage might prove useful to some, it's vital to understand exactly how it works before purchasing a policy. Indexed universal life (IUL) insurance policy plans offer better upside prospective, flexibility, and tax-free gains.

Why do I need Long-term Iul Benefits?

As the index moves up or down, so does the price of return on the cash value part of your policy. The insurance coverage firm that releases the plan might provide a minimal surefire rate of return.

Economists typically recommend having life insurance coverage that's equal to 10 to 15 times your yearly income. There are numerous downsides associated with IUL insurance policy policies that movie critics fast to explain. As an example, somebody who establishes the plan over a time when the marketplace is executing badly could wind up with high premium settlements that do not contribute in all to the cash value. Indexed Universal Life growth strategy.

Apart from that, remember the adhering to various other factors to consider: Insurer can set engagement rates for just how much of the index return you obtain annually. For example, let's say the policy has a 70% engagement price. If the index grows by 10%, your cash money value return would be just 7% (10% x 70%).

What types of Iul Investment are available?

Furthermore, returns on equity indexes are commonly capped at a maximum quantity. A policy may state your maximum return is 10% annually, despite just how well the index carries out. These restrictions can limit the real price of return that's attributed towards your account annually, no matter how well the plan's hidden index performs.

Yet it is necessary to consider your individual danger resistance and financial investment goals to guarantee that either one aligns with your overall approach. Whole life insurance policy plans typically consist of an ensured rate of interest with predictable superior amounts throughout the life of the policy. IUL policies, on the other hand, offer returns based on an index and have variable costs gradually.

Latest Posts

How Does Index Universal Life Insurance Work

Maximum Funded Tax Advantaged Life Insurance

Adjustable Life Plan