All Categories

Featured

Table of Contents

If you're a person with a reduced tolerance for market changes, this insight could be important - Indexed Universal Life for wealth building. One of the essential elements of any type of insurance coverage plan is its cost. IUL policies often come with different charges and fees that can impact their general worth. An economic advisor can break down these costs and aid you consider them versus other low-cost investment alternatives.

Pay certain focus to the plan's functions which will be crucial depending upon just how you desire to utilize the plan. Talk to an independent life insurance coverage agent who can help you select the finest indexed global life policy for your requirements.

Review the plan very carefully. If sufficient, return authorized delivery receipts to obtain your universal life insurance policy protection effective. After that make your initial premium payment to trigger your plan. Currently that we have actually covered the benefits of IUL, it's necessary to understand how it compares to other life insurance plans readily available in the marketplace.

By understanding the similarities and distinctions in between these plans, you can make an extra educated choice concerning which kind of life insurance policy is finest suited for your needs and economic goals. We'll start by contrasting index global life with term life insurance policy, which is typically considered one of the most simple and inexpensive sort of life insurance policy.

Who has the best customer service for Guaranteed Interest Iul?

While IUL may offer higher prospective returns due to its indexed money worth growth mechanism, it likewise comes with greater costs contrasted to term life insurance policy. Both IUL and whole life insurance policy are types of long-term life insurance policies that offer fatality advantage protection and money value development chances (Flexible premium IUL). However, there are some crucial differences between these 2 kinds of policies that are vital to take into consideration when determining which one is ideal for you.

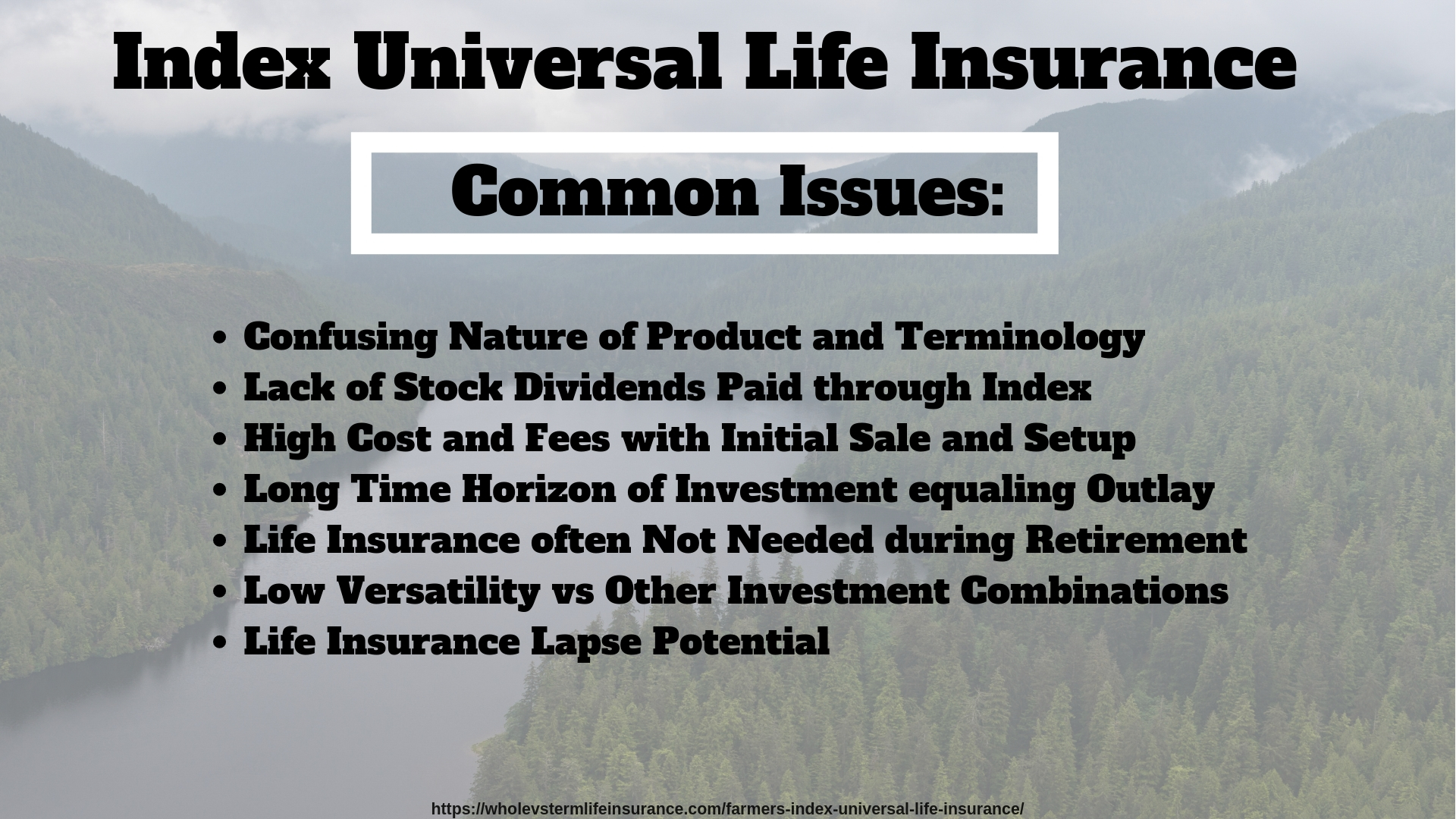

When thinking about IUL vs. all other kinds of life insurance policy, it's critical to evaluate the benefits and drawbacks of each policy kind and talk to a skilled life insurance policy representative or economic advisor to figure out the very best option for your distinct requirements and economic objectives. While IUL supplies numerous benefits, it's additionally essential to be knowledgeable about the threats and factors to consider related to this kind of life insurance coverage policy.

Allow's dig deeper right into each of these threats. One of the key problems when taking into consideration an IUL policy is the different prices and fees linked with the policy. These can consist of the cost of insurance, policy costs, abandonment fees and any extra biker prices sustained if you add extra benefits to the policy.

Some may use much more affordable prices on insurance coverage. Examine the financial investment options readily available. You desire an IUL policy with a variety of index fund options to fulfill your demands. See to it the life insurer aligns with your individual financial objectives, demands, and risk tolerance. An IUL policy must fit your particular circumstance.

Indexed Universal Life Protection Plan

Indexed universal life insurance policy can provide a variety of advantages for insurance policy holders, including flexible premium repayments and the potential to gain greater returns. The returns are restricted by caps on gains, and there are no guarantees on the market efficiency. All in all, IUL plans offer several potential advantages, yet it is important to understand their threats.

Life is ineffective for lots of people. It has the possibility for huge financial investment gains however can be unpredictable and pricey contrasted to conventional investing. In addition, returns on IUL are typically low with significant costs and no guarantees - Indexed Universal Life retirement planning. Overall, it depends upon your demands and goals (IUL for retirement income). For those looking for predictable lasting cost savings and ensured fatality benefits, entire life may be the much better choice.

Can I get Long-term Iul Benefits online?

The advantages of an Indexed Universal Life (IUL) plan include prospective greater returns, no drawback threat from market motions, defense, adaptable repayments, no age demand, tax-free fatality advantage, and loan availability. An IUL plan is long-term and supplies cash value development through an equity index account. Universal life insurance policy started in 1979 in the United States of America.

By the end of 1983, all major American life insurance companies supplied universal life insurance coverage. In 1997, the life insurance firm, Transamerica, introduced indexed universal life insurance policy which offered policyholders the ability to link policy development with international stock market returns. Today, global life, or UL as it is likewise understood is available in a selection of various types and is a significant part of the life insurance coverage market.

The information provided in this write-up is for academic and informational functions just and ought to not be interpreted as economic or investment recommendations. While the author has experience in the topic, viewers are encouraged to talk to a certified economic consultant prior to making any investment decisions or acquiring any kind of life insurance policy items.

Who offers Iul Growth Strategy?

In truth, you may not have actually thought a lot regarding just how you wish to invest your retirement years, though you most likely understand that you do not intend to lack cash and you want to keep your present way of living. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text shows up alongside the service man speaking with the camera that reviews "business pension", "social safety and security" and "financial savings"./ wp-end-tag > In the past, individuals relied on three major sources of earnings in their retirement: a business pension plan, Social Safety and whatever they 'd taken care of to save

Less companies are providing typical pension. And lots of companies have actually minimized or discontinued their retirement plans. And your capability to depend solely on Social Protection is in question. Also if advantages haven't been minimized by the time you retire, Social Security alone was never planned to be sufficient to spend for the lifestyle you desire and are worthy of.

Before dedicating to indexed universal life insurance coverage, right here are some pros and disadvantages to take into consideration. If you pick a great indexed global life insurance policy strategy, you might see your cash money value grow in value. This is valuable because you might have the ability to gain access to this money before the strategy ends.

How can Indexed Universal Life Tax Benefits protect my family?

If you can access it early, it may be beneficial to factor it right into your. Since indexed universal life insurance policy needs a particular degree of risk, insurance policy business often tend to keep 6. This kind of plan likewise offers. It is still guaranteed, and you can readjust the face quantity and motorcyclists over time7.

Lastly, if the chosen index does not carry out well, your cash value's growth will be affected. Generally, the insurance provider has a beneficial interest in executing better than the index11. There is typically an assured minimum interest rate, so your strategy's development won't fall listed below a particular percentage12. These are all aspects to be considered when selecting the best kind of life insurance coverage for you.

Nonetheless, because this kind of plan is extra complex and has an investment component, it can commonly come with higher premiums than other plans like whole life or term life insurance coverage - IUL cash value. If you don't assume indexed global life insurance policy is appropriate for you, right here are some choices to consider: Term life insurance policy is a momentary plan that generally supplies coverage for 10 to thirty years

Latest Posts

How Does Index Universal Life Insurance Work

Maximum Funded Tax Advantaged Life Insurance

Adjustable Life Plan